Background Heading

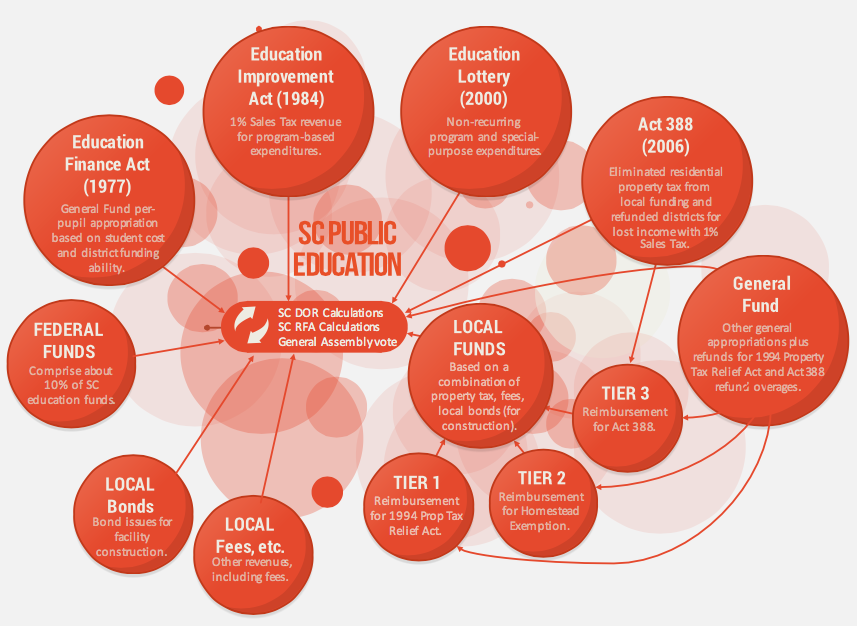

An Overview of Education Funding in SC

Download

Presented at the VisionSC 2015 conference on November 6, 2015, this presentation provides a brief overview of Education Funding in South Carolina, along with issues and ideas going forward.

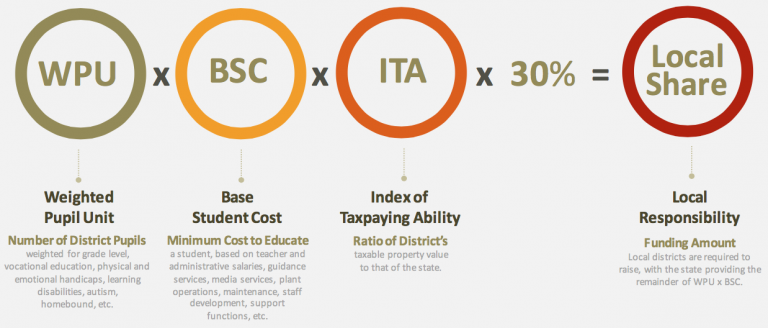

Education Finance Act (1977)

The EFA is considered the primary funding mechanism for K-12 education in South Carolina. It determines district funding based on the following:- A weighted count of district students (WPU)

- The minimum cost to educate (BSC)

- A ratio of a district’s ability to pay (ITA)

Changes in School Finance

Combined, the Property Tax Relief (1994) and Act 388 (2006) tax laws have eliminated property tax on owner occupied homes from school district taxes, replacing it with 3 “Tiers” of property tax reimbursement to counties.

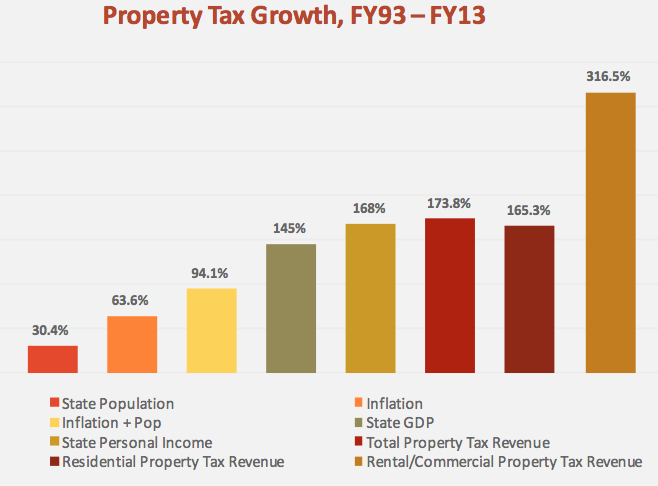

- Shifted Tax Burden: The 1977 local funding share formula based on district taxable property has been eroded by tax exemptions, shifting the local property tax burden to fewer properties, particularly rental and commercial.

- Insufficient Sales Tax Swap: Act 388 1% sales “tax swap” has fallen short of required tax reimbursements in excess of $110m annually since FY10.

- Failed to Stop Property Tax Increases: Despite multiple property tax relief laws, district property taxes have increased 50% since FY03 & 22% since FY08. Annual school district millage growth rates have more than doubled since the passing of the cap in 2006 than in the 13 years before it.